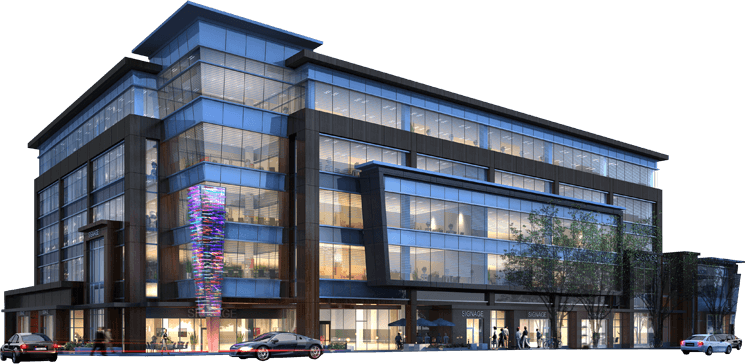

The Premier Marketplace for Trading Commercial Real Estate Investment Units

Building the NexGen Market Trading Platform for Commercial Real Estate

USA REIT Markets is a cutting-edge platform designed to democratize access to institutional-grade commercial real estate through innovative blockchain technology, enabling both accredited and non-accredited investors to participate with increased transparency and liquidity.

Investment Highlights - Series Seed Round

USA REIT Markets is the first comprehensive platform combining Regulatory compliant tokenization, dual regulatory frameworks (RegA+/RegD), integrated 1031 exchange facilitation, and regulated secondary trading for commercial real estate investments.

Key Value Propositions

- Proven Technology Platform with $750M+ capital raised through Capital Engine®

- Dual Regulatory Leadership via proprietary RegA+ and RegD frameworks with broker-dealer/ATS partnerships

- Integrated 1031 Exchange Specialization capturing $100B+ annual transaction market

- Complete Secondary Trading Solution where competitors have significant gaps

- Strong Financial Trajectory with 56% CAGR projected over 3 years across multiple revenue streams

The Opportunity

$1M Series Seed | $5M Post-Money Valuation

The first commercial real estate platform offering access to immediate liquidity through RegA+ compliance and integrated secondary trading marketplace.

Unique Value Proposition

RegA+ Liquidity Advantage

- Exit anytime vs. competitors' 3-7 year lock-ups

- Only proprietary RegA+ platform with capabilities in CRE space

Proven Foundation

- 100K+ investor network

- 100+ successful transactions

- $750M+ track record

- Over $1B in assets tokenized

1031 Exchange Specialization

- Capture $100B+ annual 1031 exchange market

- Unique revenue stream competitors lack

Regulated Secondary Marketplace

- Integrated trading platform where competitors have gaps

- Multiple revenue streams reduce platform risk

Get Instant Access To The Private Offering Memorandum, Fund Presentation And All You Need To Know To Invest.

Access Premium

Commercial Real Estate

Fractional Investments in High-Quality Properties

Series Seed Round Offering Highlights

www.usareit.com/marketplace

* T&C's apply. Past performance is no guarantee of future results. Accredited investors only.

Conservative Financial Projections

| Year | Revenue | Growth |

|---|---|---|

| 2025 | $993K | Foundation |

| 2026 | $2.3M | +128% |

| 2027 | $4.3M | +89% |

| 2029 | $10.2M | +47% |

Massive market opportunity

- $22 Trillion US commercial real estate market

- $100+ Billion annual 1031 exchange transactions

- $1.3 Trillion private CRE funds seeking liquidity solutions

- <$10 Billion current secondaries market (nascent & underserved)

Use of funds

- 30% Platform Development & RegA+ Infrastructure

- 25% Team Building & Operations

- 20% Regulatory & Compliance

- 15% Market Expansion & Customer Acquisition

- 10% Working Capital & Contingency

Investment highlights

- First-mover advantage in RegA+ CRE liquidity

- Defensive market position through regulatory expertise

- Multiple revenue streams reducing platform risk

- Conservative projections with proven execution

- Large, underserved market with validated demand

Problem

Commercial Real Estate's $3.5T Liquidity Problem

High investment minimums, typically $25k - $100,000.

Institutional dominance locks out 99% of investors.

Long 5-10 year hold periods with zero liquidity.

Investment process is manual, slow, and expensive, with costly mistakes, heavy paperwork and overhead fees.

$3.5 trillion trapped with no exit strategy.

Solution

Tokenized Real Estate with Built-in Liquidity

Low investment minimums.

Full access to high-quality investment opportunities leveling the playing field.

Instant access to liquidity with 24/7 trading on regulated exchanges.

Seamless compliance and distribution processes ensure regulatory adherence and efficient payouts.

Real estate investing as easy as buying stocks.

Company Progress - Building Momentum

Traction Points

- $750M raised through Capital Markets platform

- 100K+ investor network ready for deals

- Regulatory compliance complete (Reg D/A+)

- ATS partnership secured for trading

- Tokenization partnership secured for Digital Real Estate shares

Key Metrics

- 3 active pilot deals totaling $21M

- 500+ investors pre-registered

- Platform live and processing transactions

Competition - Why We Win

| Feature |  |

|

|

|

|

|---|---|---|---|---|---|

| Min Investment | $1K | $10 | $25K | 1$5K | $5K |

| Liquidity | Daily | Quarterly | None | None | Limited |

| Deal Access | Institutional | Basic | Limited | Selective | Moderate |

| Technology | Blockchain | Traditional | Web | Traditional | Traditional |

| Secondary Market | Yes | No | No | No | No |

Competitive Advantages

- RegA+ Liquidity

- Regulated Secondary Trading

- 1031 Exchange Ready

- Proven $750M+ Platform

- Future proof Blockchain technology

- $1B+ assets tokenized

- 3-7 Year Lock-ups

- Limited/No Trading

- No Exchange Services

- Unproven Technology

- Outdated Infrastructure

- Minimal Assets Digitized

USA REIT Markets Investment Round

Series Seed Offering Highlights

- $1 million raise (post-money valuation $5 million)

- 20% discount on $1 share price*

- Min. Invest: $20,000

- Actively raising $250 million for clients

- Deal pipeline: $650 million+ potential raises

- Funding will accelerate and scale revenue growth focusing on strategic partnerships, expanding broker-dealer, sales and marketing, onboarding key staff, and setup of secondaries trading platform

USA REIT Markets Perpetual Financing Round

| Share Price | Pre-Valuation | Post-Valuation | Amount Raised | Shares to be sold | Ownership Dilution |

|---|---|---|---|---|---|

| $1 / share | $4,000,000 | $5,000,000 | $1,000,000 | 1,000,000 | 20% |

| $2 / share | $8,000,000 | $10,000,000 | $2,000,000 | 1,000,000 | 20% |

| $4 / share | $16,000,000 | $18,000,000 | $2,000,000 | 500,000 | 11% |

Institutional Grade Infrastructure

Technology Layers

- Regulatory Compliant Tokenization Smart contracts ensure regulatory compliance with transparent and immutable transaction records

- Automated Smart Contracts Streamlined operations and distributions powered by battle-tested blockchain architecture

- Institutional Custody Integration Bank-grade security and asset protection with enterprise-level compliance frameworks

- Real-time Portfolio Management Live tracking and performance analytics with institutional-grade reporting

- ATS-Powered Secondary Trading Partnership with registered broker-dealer for compliant digital asset trading and secondary market liquidity

Built on proven Capital Markets Platform

$750M raised to date

- Track Record: Demonstrated success managing $750M in assets with institutional-grade infrastructure

- Market Leadership: Established position in alternative investment platforms with proven scalability

- Operational Excellence: Years of refined processes and risk management protocols

- Investor Confidence: Significant capital under management validates platform reliability

Partnership with registered

Broker-Dealer & ATS

- Partnership Registered ATS: Provides access, liquidity, and transparency for investors in the secondary market

- Secondary Market Capability: Licensed to facilitate trading of digital securities post-issuance

- Investor Protection: Regulatory framework provides institutional-level safeguards for all participants

Blockchain technology partner

10+ years of Expertise

- Proven Scale: $1B+ tokenized assets demonstrates technical competency

- Security Leadership: Zero security breaches across all platforms shows robust Cybersecurity

- Compliance Infrastructure: Institutional-grade systems built for regulatory environments

- Multi-Jurisdictional Approval: Regulatory approvals across multiple markets prove adaptability and compliance excellence

Timeline

Q3 2025

Funding close

Q4 2025

Full platform launch

Q1 2027

Break-even

Q2 2027

Series A

Funding

Raising $1M Seed Round

18-month runway to achieve

20+ deals on platform

$100M+ AUM under management

5,000+ active investors

Series A ready ($15M+ revenue run rate)

Use of Funds

Platform Development & Security

Sponsor Acquisition & Partnerships

Legal & Regulatory Compliance

Team & Operations

Experienced Leadership

Our team combines deep CRE, blockchain, compliance & investor relations

expertise,

led by Bryan Smith & Laura Pamatian, supported by expert advisors.

Bryan Smith

CEO & Founder

- 30+ years commercial real estate experience

- Founded Capital Engine® in 2018

- $750M+ raised using Technology

Laura Pamatian

COO

- 20+ years real estate & development experience

- Regulatory Compliant Series 7/63 licensed; online capital formation

- Deep expertise in the tokenization of real estate securities