Revolutionize Real Estate Investment Through Blockchain Tokenization

Access fractional ownership, up to 24/7 trading access vs. traditional illiquid investments, and automated compliance through USA REIT Markets's regulated ATS platform for tokenized real estate securities

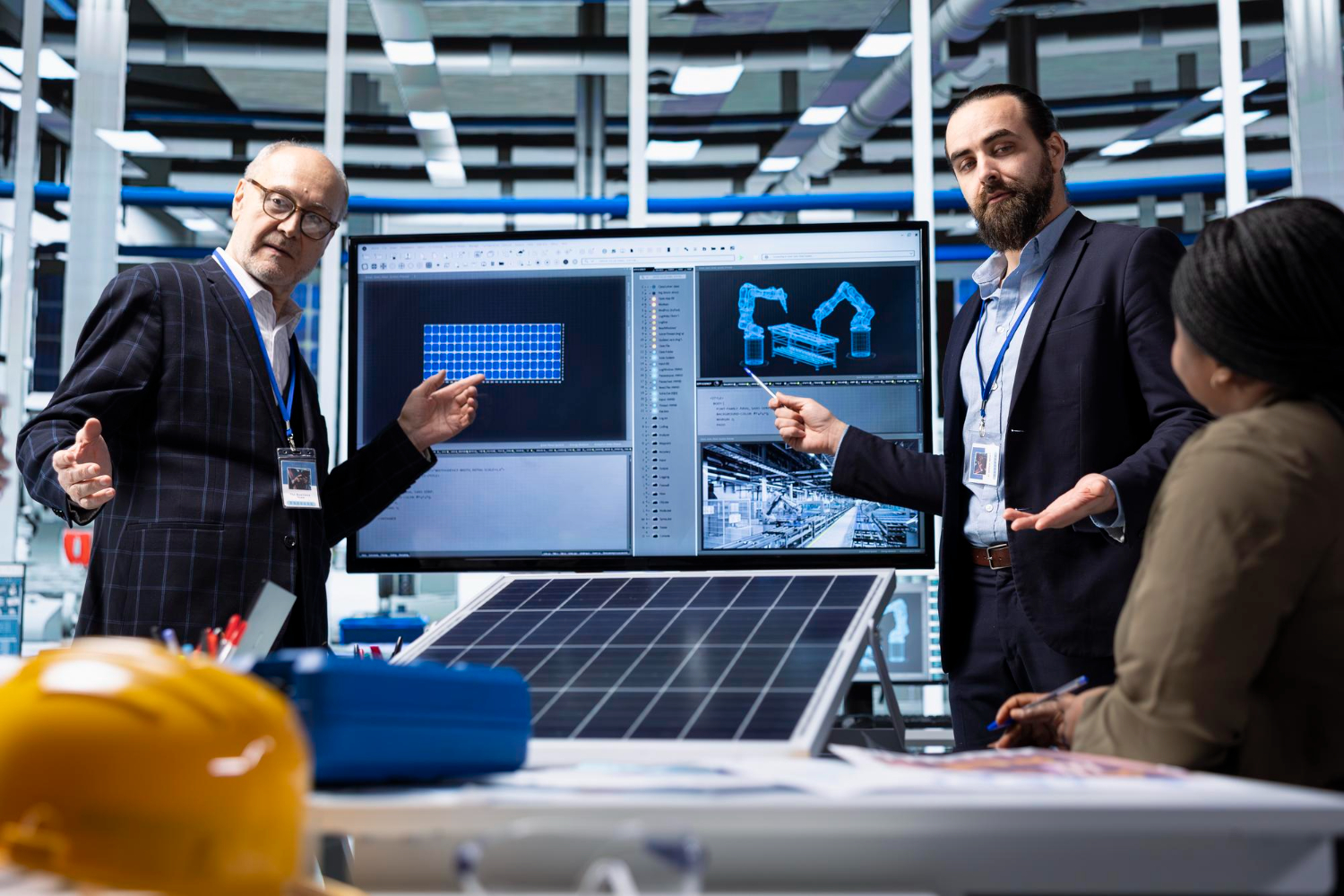

Institutional-Grade Blockchain Technology is the Future of

Real Estate Investment

The infrastructure shift is here. Leading institutions including BlackRock, JPMorgan, Goldman Sachs, and Franklin Templeton have moved beyond experimentation—they're actively deploying blockchain technology to issue and manage tokenized securities at scale.

The market opportunity is massive. The Deloitte Center for Financial Services predicts that US $4 trillion of real estate will be tokenized by 2035, representing a fundamental transformation in how real estate assets are owned, traded, and managed.

Position your real estate offerings at the forefront of this transformation. USA REIT Markets's tokenization platform delivers the efficiency, transparency, and liquidity that today's sophisticated investors demand while maintaining full regulatory compliance.

Compliance Excellence

Built on Trust & Security

Regulatory compliant Broker-Dealer

Operating under full regulatory compliant with AML compliance programs

Institutional-Grade Security

Advanced blockchain and cybersecurity infrastructure through strategic partnerships

Comprehensive KYC/AML

Automated identity verification and anti-money laundering compliance

Advantage

Advantage

Over $1B in Tokenized Assets

Since 2017, our team has tokenized across multiple asset classes:

- Real estate funds and direct property investments

- Private equity and venture capital offerings

- Public and private debt securities

- Alternative investment structures

Reg A Offerings Expertise

We specialize in Reg A offerings and tokenization solutions:

- Essential for tokenization - provides a scalable path for issuing and managing real estate interests to the public

- Enables companies to raise capital from both accredited and non-accredited investors

- Unlocks liquidity and accessibility like never before

- Comprehensive regulatory compliance and filing support

Enterprise-Grade Infrastructure

Our platform delivers institutional-quality features:

- Smart contract engineering with multi-signature security protocols

- Compliance-first architecture designed specifically for regulatory standards

- AI-driven automation for transfer administration and reporting

- Cross-border functionality supporting international investors

- Scalable infrastructure handling offerings from $5M to $500M+

Why Leading Institutions Are Embracing Tokenization

Liquidity Revolution

- Substantially reduced settlement times compared to traditional transfers

- 24/7 trading capability on compliant secondary markets

- Fractional ownership enabling portfolio diversification

- Automated market making providing consistent liquidity

Operational Efficiency

- Significant reduction in administrative costs through automation

- Real-time compliance monitoring with automated reporting

- Immutable audit trails simplifying due diligence

- Programmable distributions eliminating manual processes

Risk Mitigation

- Enhanced security through cryptographic protection

- Reduced counterparty risk via smart contract automation

- Transparent ownership records preventing fraud

- Instant settlement eliminating settlement risk

Smart Automation

Effortless Management

Contact Information

USA REIT Markets offers a secure, interactive marketplace and secondary trading infrastructure for Private REIT's, Real Estate Funds, Syndications and 1031 Exchanges

ENQUIRY | SUPPORT

Trade With Confidence

- Regulated ATS Trading - Trade tokenized real estate securities in a fully compliant, regulated environment

- Same-Day Settlement - Execute trades with instant settlement capabilities

- Optional Liquidity Access - Investors can access liquidity when needed, unlike traditional illiquid real estate investments

- Compliant Trading Platform - Built-in regulatory compliance ensures trades meet regulations

- Market Transparency - Real-time pricing and trading data available to all participants

- Reduced Transaction Costs - Eliminate traditional real estate transaction fees and closing processes

Traditional VS Tokenized

| Traditional Workflow Process | Tokenized Workflow Process |

|---|---|

|

Manual Process Prone to documentations errors |

Automated Digital Record Secure Blockchain tracking |

|

Limited Visibility Can't track origins – black box process |

Full Transparency Complete visibility origin verification |

|

Slow Payment 30 - 90 day cycles cash flow problems |

Instant Payment Smart Contracts automated release |

|

Fraud Risk Vulnerable to fraud manual verification |

Fraud Prevention Cryptographic security immutable records |

Traditional Workflow Process

Tokenized Workflow Process

Manual Process

Prone to documentations errors

Automated Digital Record

Secure Blockchain tracking

Limited Visibility

Can't track origins black box process

Full Transparency

Complete visibility origin verification

Slow Payment

30 - 90 day cycles cash flow problems

Instant Payment

Smart Contracts automated release

Fraud Risk

Vulnerable to fraud manual verification

Fraud Prevention

Cryptographic security immutable records

Tokenization Workflow

Steps involved in asset tokenization

Success Metrics That Matter

Benefits for Sponsors

- Accelerate fundraising cycles through enhancing investor confidence.

- Expand investor reach beyond traditional networks.

- Reduce administrative burden by leveraging automation.

- Improve investor retention with transparency and modernizing the investment experience.

- Attract Institutional capital with digital-first investment solutions.

- Reduce operational complexity and risk by automating distributions and compliance through smart contracts.

- Future-proof offerings with tokenization.

- Unlock trapped capital

Benefits for Investors

- Access to liquidity reducing lengthy capital lock-ups.

- Enhance investment transparency.

- Gain entry to high-quality real estate previously limited to institutions.

- Real-time portfolio insights and reporting on investment holdings.

- Automated distributions and comprehensive tax reporting.

- Simplify diversification with fractional ownership across multiple assets.

- Reduce transaction costs associated with trading and management.

- Invest confidently on a secure and regulated platform.

Why Tokenization Gives You the Competitive Edge

Accelerate Capital Formation*

Streamline Fundraising and Expand Global Access with Smart Capital Tools:

- Gain access to 100% of global investors, unrestricted by traditional constraints

- Automate compliance reducing friction and administrative overhead

- Real-time settlement eliminating lengthy transfer processes *Subject to regulatory compliance.

Solve the Liquidity Challenge

Traditional real estate investments lock up capital for years. Tokenization changes this equation:

- Secondary market access through regulatory compliant trading platforms

- Fractional ownership enabling broader investor participation

- Reduced minimum investments expanding your addressable market

- Faster exit strategies for investors seeking flexibility

Enhance Investor Satisfaction

Boost Investor Trust and Engagement with Transparent, Automated Solutions:

- Transparent ownership records on immutable blockchain ledger

- Automated dividend distributions with programmable smart contracts

- 24/7 portfolio visibility through investor dashboards

- Seamless reinvestment opportunities driving capital retention

Ready to Transform Your Real Estate Investments?

- Access global investor base

- Reduce operational complexity

- Future Proof Your Offerings

Sponsors: Power Your Next Raise with USA REIT Markets

- Start investing in less than 5 minutes and with as little as $1,000

- Manage investments, collect dividends, reinvest all in one place

- Choose to list on the ATS for access to liquidity