Company Overview

Accretiv is a Global Real Estate Investing Firm

Accretiv was founded by a small group of seasoned entrepreneurs who started off looking for their own investments in global commercial real estate.

We have grown our portfolio of medical real estate steadily over the past 3 years, with a goal of achieving $1 billion in portfolio value before the planned portfolio sale or IPO in 2028. We currently distribute dividends to investors in more than 30 countries.

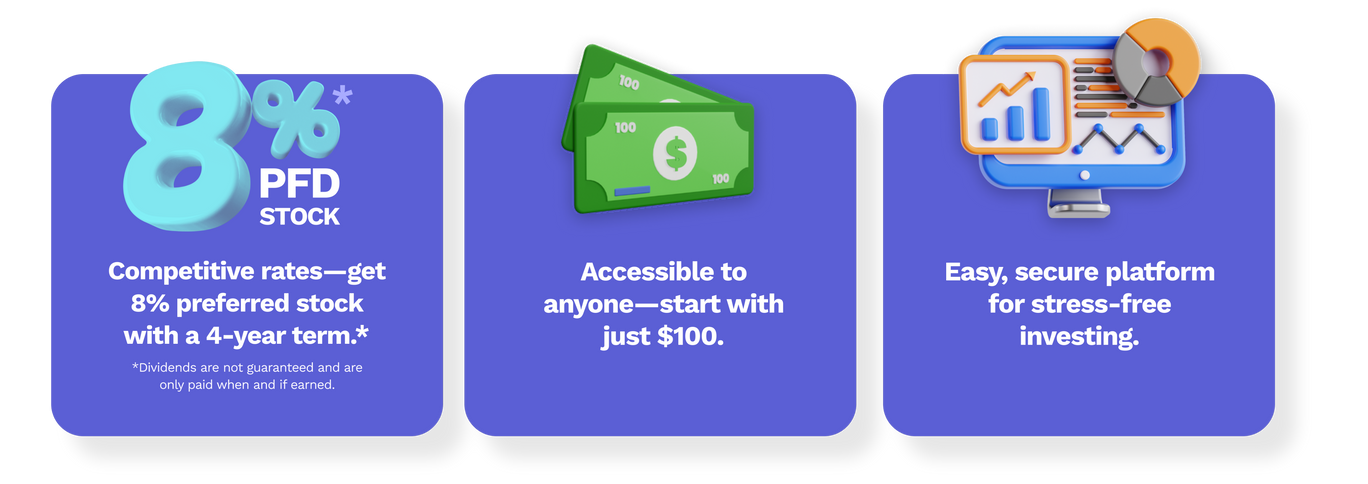

Wealthcare Property Fund

We are offering 8% preferred stock with budget-friendly real estate investments in healthcare. Get started with as little as $100, making entry-level medical real estate opportunities a reality for investors of all income levels and experience.

We understand how frustrating it can be to see investment opportunities limited to “accredited” investors with unreachable $100K minimums. It often feels like yet another way for the wealthy to build wealth while others are left behind. But where’s your chance to grow your savings, build wealth, and secure your future? It’s right here—with an accessible, reliable way to invest in medical real estate and earn consistent returns.

Dividends are not guaranteed and are only paid if earned. Alternative investments are speculative and illiquid including the potential loss of principal. Past performance is not indicative of future results. This Regulation A+ offering is capped at $75M annually. Dalmore Group, LLC, a FINRA/SIPC member, is the broker-dealer of record and is not affiliated with Accretiv. Important information, disclosures, and risks can be found at AccretivUSA.com/Disclosures.